Inward Wire Transfer

Efficient Management of Retail and Corporate Inward Remittances

Efficient Management of Retail and Corporate Inward Remittances

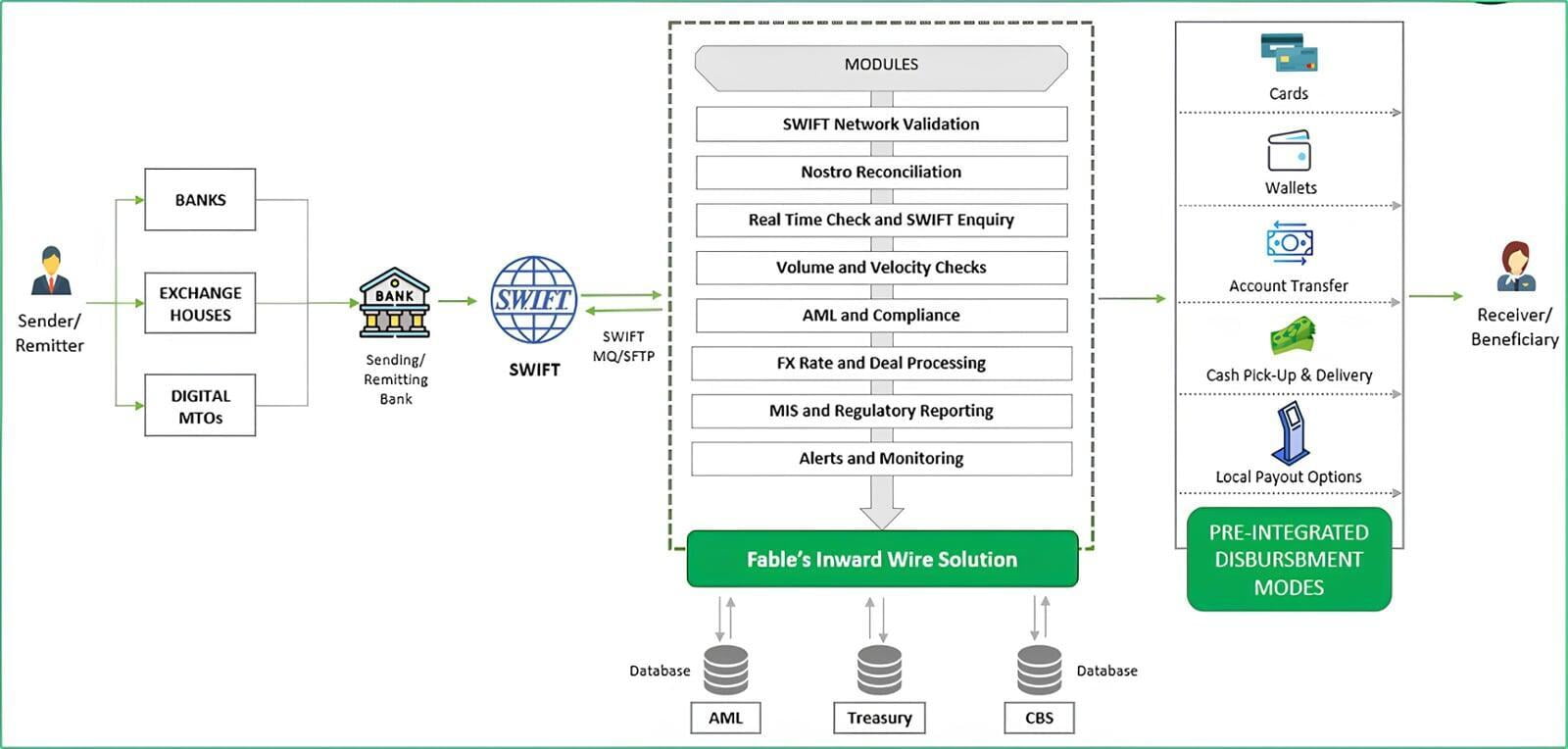

Inward wire transfers that will enable banks to enhance their offerings in the cross-border remittance space for their beneficiaries.

INWARD WIRE TRANSFER

Now provide enhanced transaction efficiency with Inward wire transfer platform

Now provide enhanced transaction efficiency with Inward wire transfer platform

INWARD WIRE TRANSFER FUNCTIONS

Introduce an expanded range of remittance services tailored for our beneficiaries.

Introduce an expanded range of remittance services tailored for our beneficiaries.

User Access Management Function

User Access Management Function

Allows admins to define roles and assign responsibilities. User access management can be set for single-person control or maker-checker validation."

Reporting Function

Reporting Function

Reporting, including regulatory and non-regulatory data, aids transaction reconciliation and tracking, with transaction reports, monthly/daily charge reports, customizable scheduling, and IT access to system-level audit logs

Compliance Function

Compliance Function

Compliance functionality, automated or manual, is facilitated through API integrations with the bank's systems, allowing users to manually decide on transaction processing.

Operations Function

Operations Function

The platform enforces validity checks on country and currency, manages charges, offers MIS/Reporting with auto-email triggers, records all transaction activities for audit, facilitates SWIFT messaging workflows, enables initiation and authorization via SWIFT alliance or manual upload, allows document uploads, and supports reconciliation through various reports.

RELATED SERVICES