The Thirsty Crow: Pebbles to make Cross Border Payment Easier

The Thirsty Crow: Pebbles to make Cross Border Payment Easier

Once upon a time, there was a crow. On a hot, summer day he flew in search of water here and there. After a long search and no water in sight, he stopped near a pile of broken pots to rest. In one of the broken pots, there was some water but the water was low and far from the reach of his beak. The crow tried to reach the water several times but failed. He was tired and thirsty.

| Table of contents |

|

Cross-border Payments - The Unreachable water

Cross border transactions are complex, time-consuming processes. In 1973 to make international payments easier, 239 banks from 15 countries developed the SWIFT protocol. SWIFT is not a means of money exchange but a communication portal through which standardized messages containing transaction information can be shared by banks.

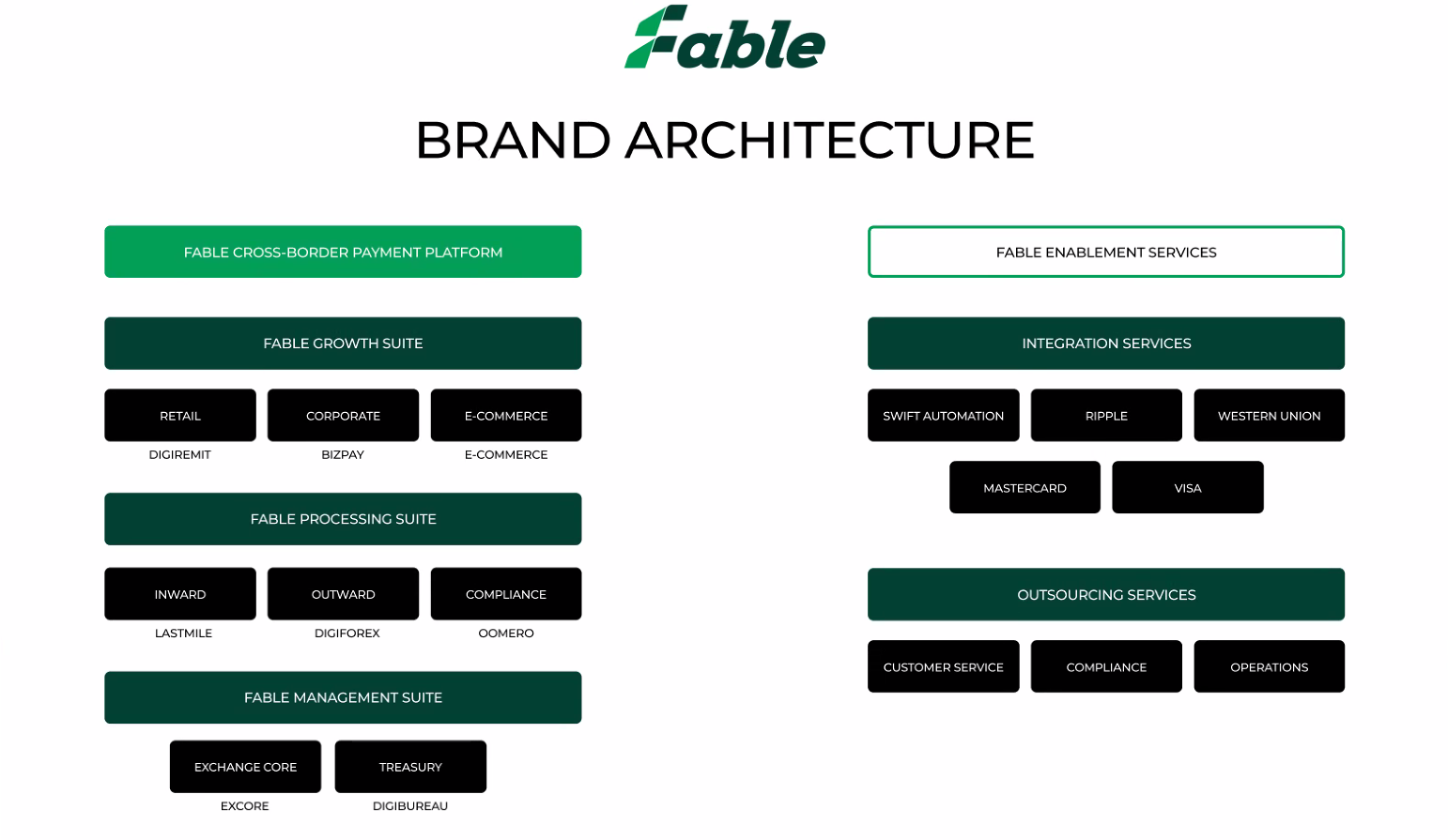

Fable Cross Border Payment services: Bring the water to you

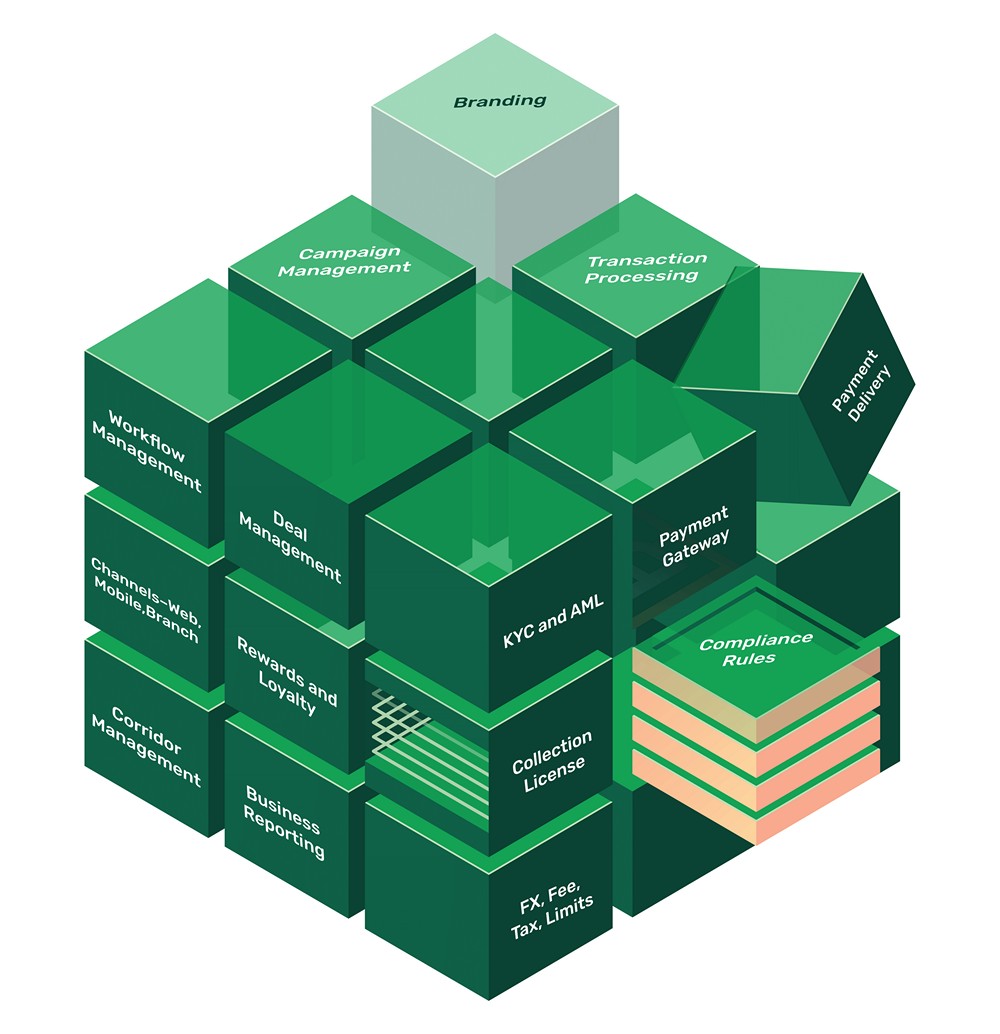

In the of cross-border payments market there is no one-size-fits-all method of doing business. Hence, Fable Cross Border Payment software brings to you a piece wise integration of different modules to serve your unique payment needs. Each module, just like every pebble in the fable of the thirsty crow, has its own importance, its own place in the cross-border payment chain.

Fable Growth Suite

Fable offers an end-to-end solution for cross border payments needs of your retail customers. Retail remittances are often a large number of low-value payments. Such payments are not cost-effective for banks because of the intermediaries who claim a large share of the profits. Having a single point of integration for all steps of the payment chain will help improve profitability for retail payments.

- Payment gateway for different modes of payment

- Platform independence. Fable software can be integrated with mobile banking, net banking as well as the existing payment system in the bank branch.

- Partnership management for collection and disbursement of funds. You can create new partnerships and/or update the terms of existing partnerships with a click of a button

- You can work with different partners across multiple corridors

- Customer authentication service (KYC)

- Regulatory compliances

- Easily configurable product offerings. You can alter fees, tax rates, set limits etc as needed for separate payment corridors

- Run promotional campaigns

- Anti-money laundering checks

- Deal management

- Workflow management

Fable Processing Suite

The Fable Processing Suite is for organisations that already have a payment service for customers but lack the resources to expand their network to other countries. Fable provides a one-step integration backend solution to manage cross border payments.

The focus could be on:

- Inward Payment Processing

- Outward payment processing

- Compliance management

- A Hybrid of the above

Fable brings with it an existing network of licensed partners which can be leveraged for rapid go-to-market offerings. Just as the pebbles fit into the pot to take place of the water. Fable modules fit snugly to provide hassle-free integration with your existing system.

Fable Enablement Services

The Fable Platform offers different modules as stand-alone offerings for your unique needs.

In addition to the modules listed above, here are some other modules available as stand-alone service;

- VISA / MasterCard integration

- SWIFT automation

- Western Union integration

- Ripple integration

- Customer Services

- Compliance checks

- Operations management

Conclusion

Fable Cross Border payment software provides you with the liberty to enter the cross border payments ecosystem on your own terms. Fable integration will help you lower transaction costs, promote interoperability and reduce the time taken to complete a foreign remittance payment while making you future-ready with their agile offerings. Like the pebbles in the fable, using the Fable product modules you can enter the turbulent waters of the international payments ecosystem with ease.

To acquire the platform, book a demo with the Fable Fintech cross-border platform experts;