Non-Alignment Movement in International Payments

Non-Alignment Movement in International Payments

Non-alignment originated as a policy of non-involvement in military affairs of a dichotomous world. During the cold war, India refused to take sides of either the USA or the USSR amidst the ongoing tensions between the two nations. This non-alignment strategy gave India much-needed independence of action in its foreign policy and relations.

| Table of contents |

|

Beyond geopolitics, non-alignment is also a valuable business strategy. Imagine that you are a bank trying to enter the growing international payments market. Building a direct presence, that is, setting up a branch in a foreign country could take years. Thus, you partner with local financial institutions and banks and utilize their market presence to expand your cross-border payment facilities.

- Develop your own backend infrastructure to manage payments with different partners across different corridors. Though you would have complete control and transparency over operations, this approach is expensive and time taking.

- Partner with a single Money Transfer Operator (MTO) which already has a payment network across different countries. Their established market presence helps in speedy go-to-market. However, this option leaves little room for autonomous decision-making.

Alignment with single operator: Key challenges

Partnering with a Money Transfer Operator (MTO) will allow you to dive into the internal payment market speedily. However, speed is obtained at the expense of low transparency and lack of control.

- Low Control: Your cross-border transactions will take place as per standard practices defined by the technology available to the MTO. Unlike India during the cold war, you will not have complete independence of action in the sphere of cross-border payments.

- Low profitability: The net profit per transaction will also reduce as the MTO will pocket a major share of the money made over cross-border payments.

- Single point of Dependency: Depending on a single operator in a turbulent ecosystem will leave you vulnerable to serious business risks. They might decide to increase their service rates, or shut down operations in a certain corridor. This could be fatal for your business.

The Platform Approach: Non-alignment in Cross-border payments

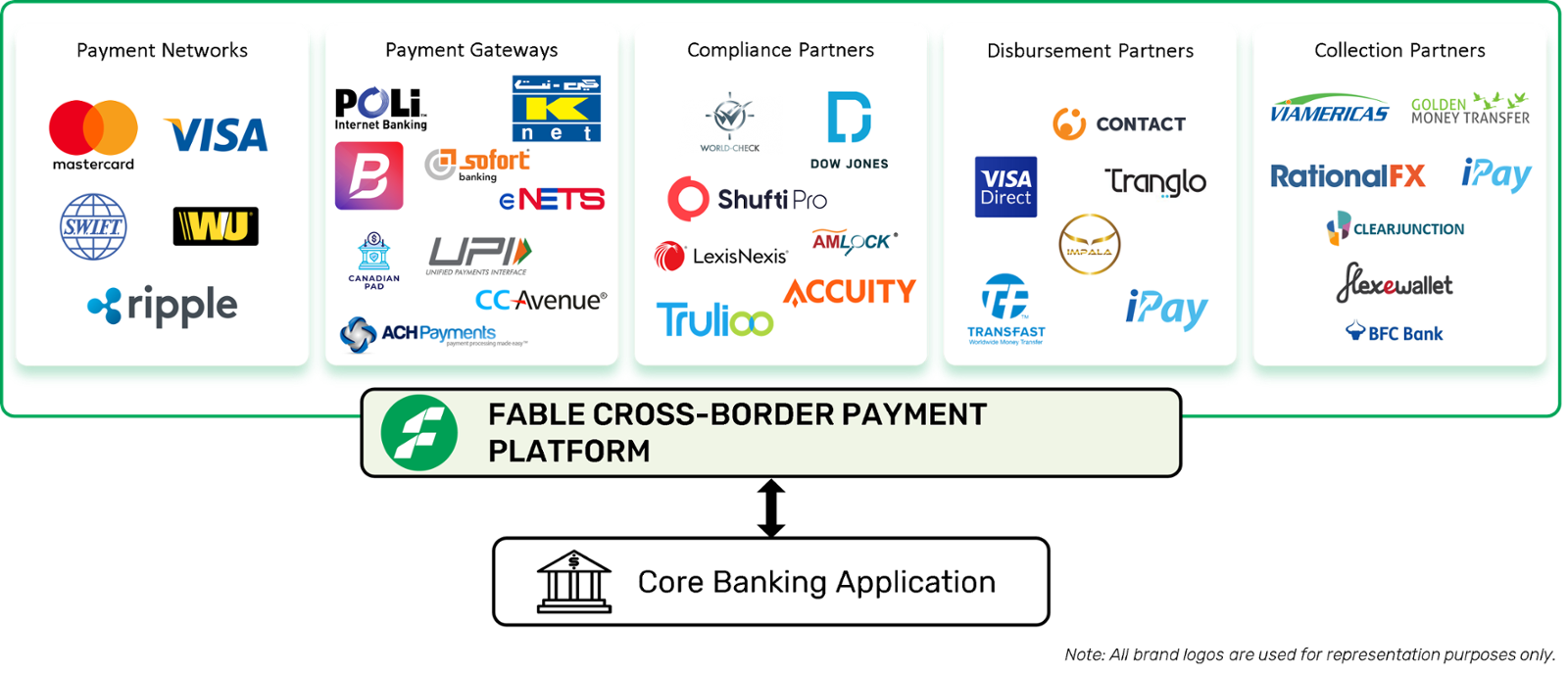

The cross-border payments landscape is evolving and there is a greater need to leverage technology to provide fast, secure, low-cost solutions for international payments. Many companies like Fable Cross Border payments platform provide technology solutions to help banks integrate their payment systems with that of their international partners for smoother transactions.

Rapid go-to-market: Go live in 30 days

The Fable platform comes pre-integrated with the payment ecosystem. This includes payment gateways, regulatory technology products, license and disbursement partners. Thus, with a single point of integration, you can build the complete international payments infrastructure for your unique business needs.

Higher Profits: No middleman to eat the pie

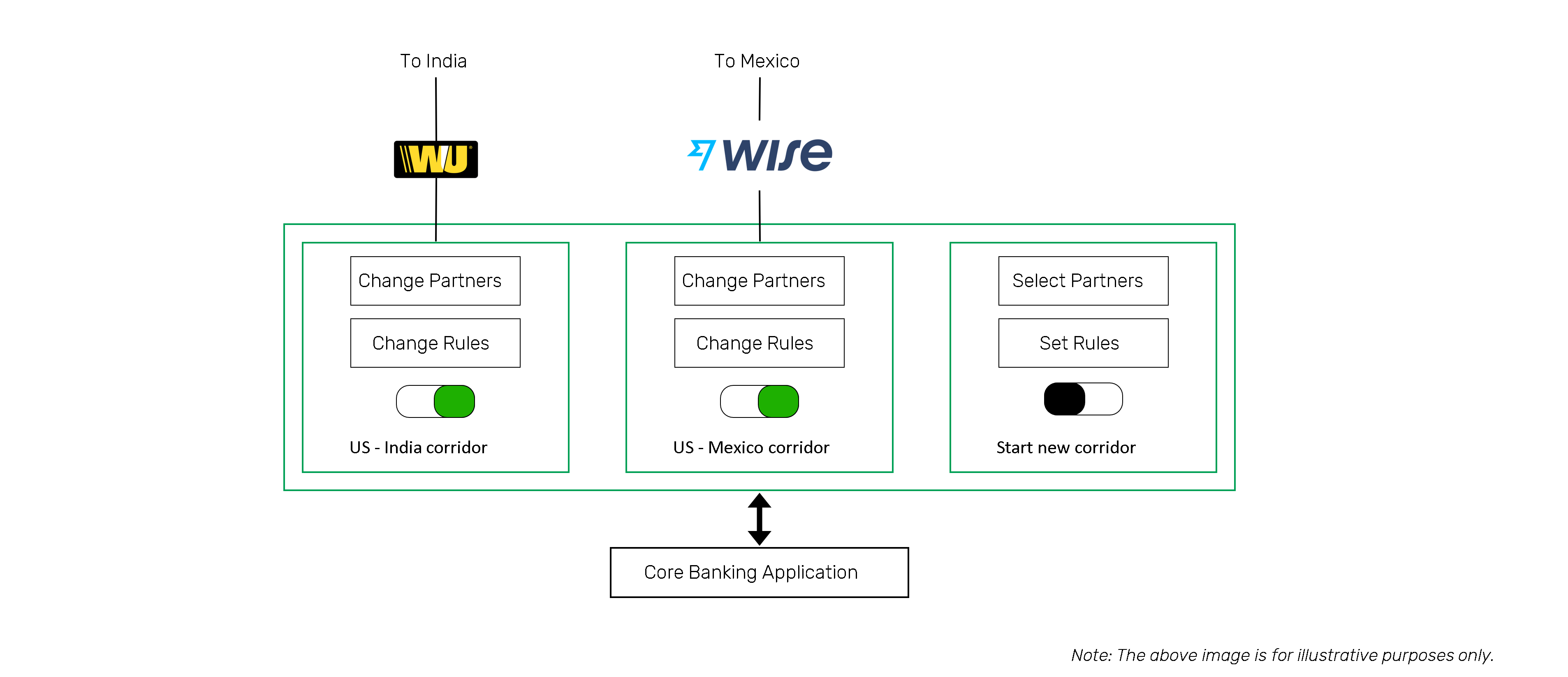

With Fable, you generate more revenue per transaction. You participate at every stage of the remittance chain without MTOs burning a hole in your pocket. You also have the freedom to choose and change partners with a single click. You save on marginal costs that come with every new integration.

Control: Your business, your terms

Fable platform provides you with more control and agility with its reconfigurable, plug-n-play architecture. You can work with multiple partners in different payment corridors. You can dictate your terms of partnerships and if your partner fails you can change partners with a click of a button.

Flexibility: Compete and Collaborate with MTOs

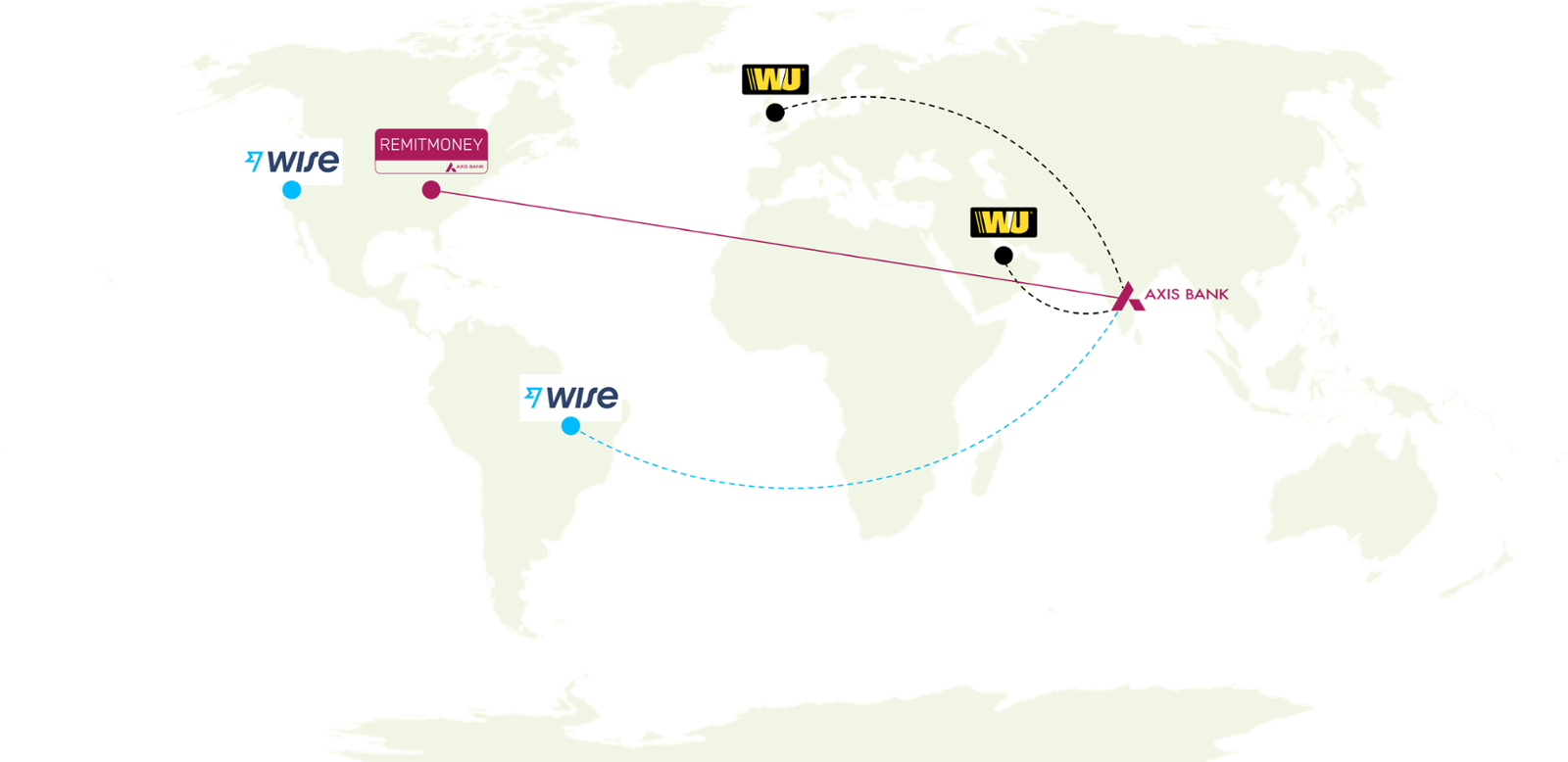

By not taking sides, India safeguarded its sovereignty. However, this does not mean that India developed in isolation. During the late 1950s, India welcomed financial and technical assistance from the Soviet Union for the development of India’s industries. During the cold war, the USA also supported India through food aid. In a similar manner, the Fable platform allows you to collaborate with multiple MTOs in different corridors.

Conclusion

Addressing the Parliament in February 1953, the Prime Minister of India stated: “To become part of a power bloc means giving up the right to have a policy of our own and following that of somebody else. We should co-operate with others or consult them but at the same time must follow an independent policy.”

To acquire the platform, book a demo with the Fable Fintech cross-border platform experts;

REFERENCES:

“Defining Foreign Policy”, Speech by Prime Minister Jawaharlal Nehru during debate on the President’s Address in Parliament, New Delhi, February 17, 1953, in Jawaharlal Nehru’s Speeches 1949-1953, Publications Division, Ministry of Information and Broadcasting, Government of India, New Delhi, 1954.