CBDC & Fintech Can Make Cross-border Payments Affordable For Business

CBDC & Fintech Can Make Cross-border Payments Affordable For Business

There are over a 100 countries developing CBDCs. The Sand Dollar in the Bahamas has been in circulation for quite a while. In China the launched pilot CBDC, e-CNY continues to grow and is expected to be circulated nation-wide soon. A digital currency flood that promises more social inclusion, more safety and lower costs is all set to bring about huge changes in the financial sector and impact businesses and individuals, if certain challenges are met.

| Table of contents |

|

An intro to CBDC

A Central Bank Digital Currency (CBDC) is a digital representation of a country's fiat currency that also serves as a claim on the central bank. Instead of printing money, the central bank issues electronic coins or accounts that are backed by the government's full faith and credit. In simple language, a CBDC (Central Bank Digital Currency) is a type of digital currency that is issued and backed by a central bank. It is similar to traditional physical currencies, such as the Yen, US dollar or the euro, but it exists in digital form and can be used to make electronic payments or transactions. CBDCs are considered to be a potential alternative to traditional fiat currencies, and they have the potential to revolutionize the way that central banks issue, manage money and bring about changes in the cross-border remittance business.

The current digital currency market

As you are aware, thousands of digital currencies, also known as cryptocurrencies, are already available on the market. The most well-known fully decentralised cryptocurrency is Bitcoin. Cryptocurrencies use distributed-ledger technology, which means that multiple devices all over the world, rather than a single central hub, are constantly verifying the transaction's accuracy. Stablecoins are another type of cryptocurrency whose value is linked to an asset or a fiat currency, such as the US dollar.

Why is there a need for CBDC?

There are several reasons why governments and central banks may be interested in issuing a CBDC. Some of the potential benefits of a CBDC include:

What are the concerns around CBDC?

There are several challenges and risks associated with the use of CBDCs that governments and central banks will need to carefully consider. Some of the potential challenges include:

The current global CBDC situation

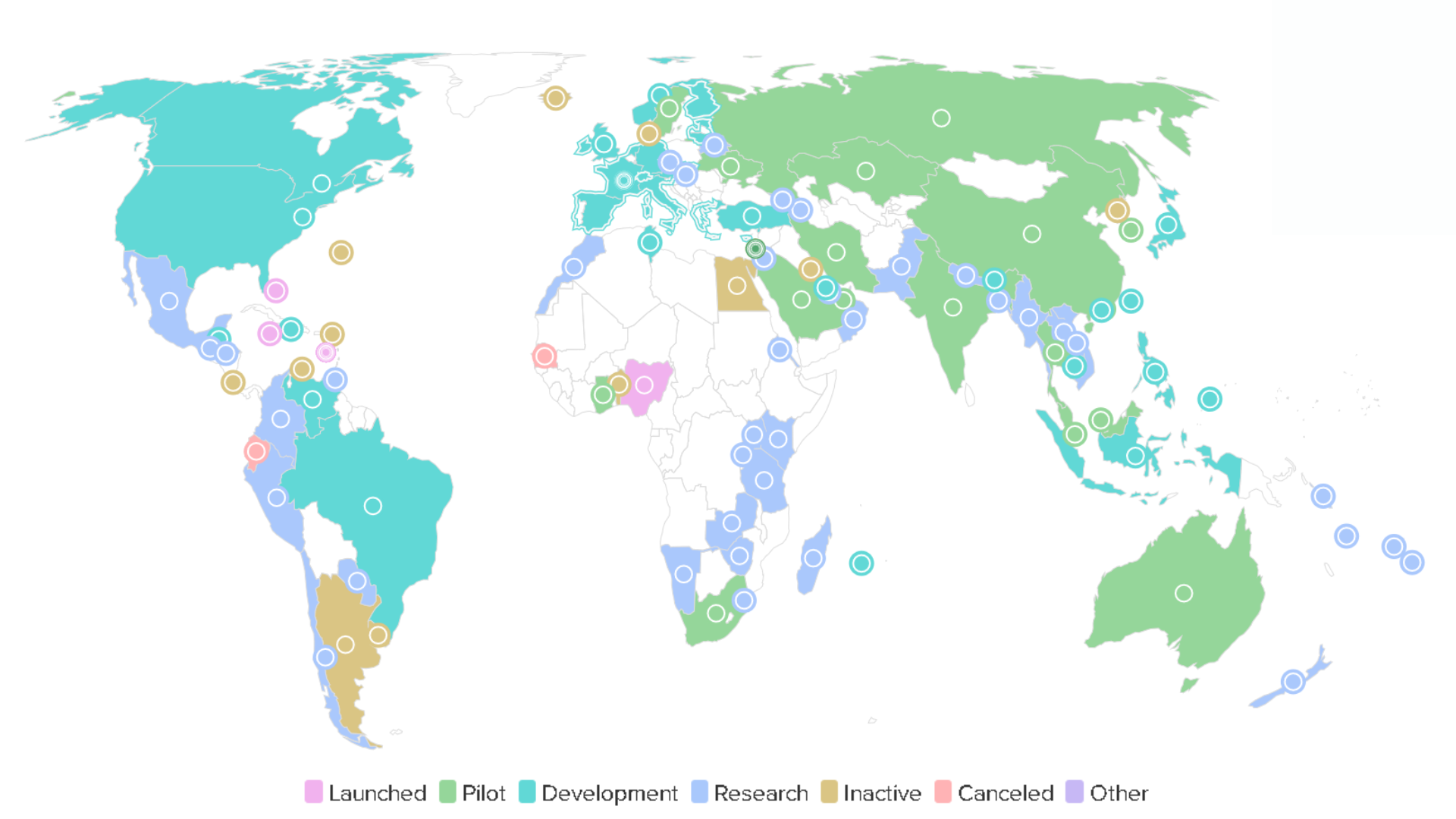

Source: www.atlanticcouncil.org

Right now, about 114 countries are in phase to develop a CBDC. There is no surprise that China, in its pilot stage CBDC is all set to expand its digital currency to most of the country. It’s CBDC already reaches about 260 million of its citizens. There are about 7 retail cross-border CBDC tests and 9 wholesale cross-border CBDC tests being conducted around the globe. You can know more about wholesale and retail cross-border remittance here.

Multi-country CBDC experiments

Onyx/Multiple wCBDC: The Banque de France completed a successful wholesale cross-border payments experiment in July 2021 with the Monetary Authority of Singapore using JP Morgan’s Onyx.

How will CBDC impact international businesses?

A potential impact of CBDCs on international businesses is that they could make cross-border payments faster and more efficient. Because CBDCs are digital, they can be transferred and settled instantly, rather than having to go through the process of physically moving cash or using intermediaries. This could reduce the cost and time required for cross-border payments, which could make it easier for businesses to trade internationally.

How will CBDC impact cross border payment providers?

Central bank digital currencies (CBDCs) could potentially have a significant impact on cross-border payment solution providers (cross border payment technology companies), as they may provide a new way for central banks to facilitate cross-border payments. Currently, cross-border payments are often facilitated through intermediaries such as commercial banks, which can add complexity and cost to the process. CBDCs could potentially provide a more efficient way to make cross-border payments, as they could be exchanged directly between central banks without the need for intermediaries. This could potentially disrupt the business model of some cross-border payment solution providers, as they may no longer be needed to facilitate certain types of payments.

Solutions for global CBDC interoperability

The main purpose of these models being evaluated is interoperability. Although the ideal situation would be all the central banks of the world coming together to agree upon setting common standards to allow interoperability. Below are mentioned two more models being looked at.

An opportunity for fintech

CBDCs could also create new opportunities for cross-border payment solution companies. A CBDC allows banks and fintech firms to reinvent parts of their traditional business. As an entirely new payment use-case is created, several financial intermediaries (payment processors and aggregators, card networks, and e-wallet service providers) are expected to play a significant role in the onward march of a CBDC. For example, they may be able to develop new software solutions to help central banks and other financial institutions manage and use CBDCs for cross-border payments. It is also possible that CBDCs could potentially be integrated into the existing infrastructure used by cross-border payment companies. This could allow these companies to continue to operate as before, but using CBDCs as a settlement asset. Additionally, CBDCs may increase the overall volume of cross-border payments, which could create new business opportunities for companies in the sector.

Conclusion

With the implementation of CBDC seeming inevitable, many major cross border payment providers have already started developing solutions to allow banks and financial institutions to integrate their CBDC into their cross-border payment systems. Fable Fintech has been a silent cross border payments technology partner to some of the biggest global banks in the world To learn more about the right cross border remittance solutions for your business, get in touch with a Fable Fintech cross-border payment solutions team now!

To acquire the platform, book a demo with the Fable Fintech cross-border platform experts;